Resources for Gross Pay, Net Pay and Deductions

-

Questions

12

With Worked SolutionClick Here -

Video Tutorials

1

Click Here -

HSC Questions

1

With Worked SolutionClick Here

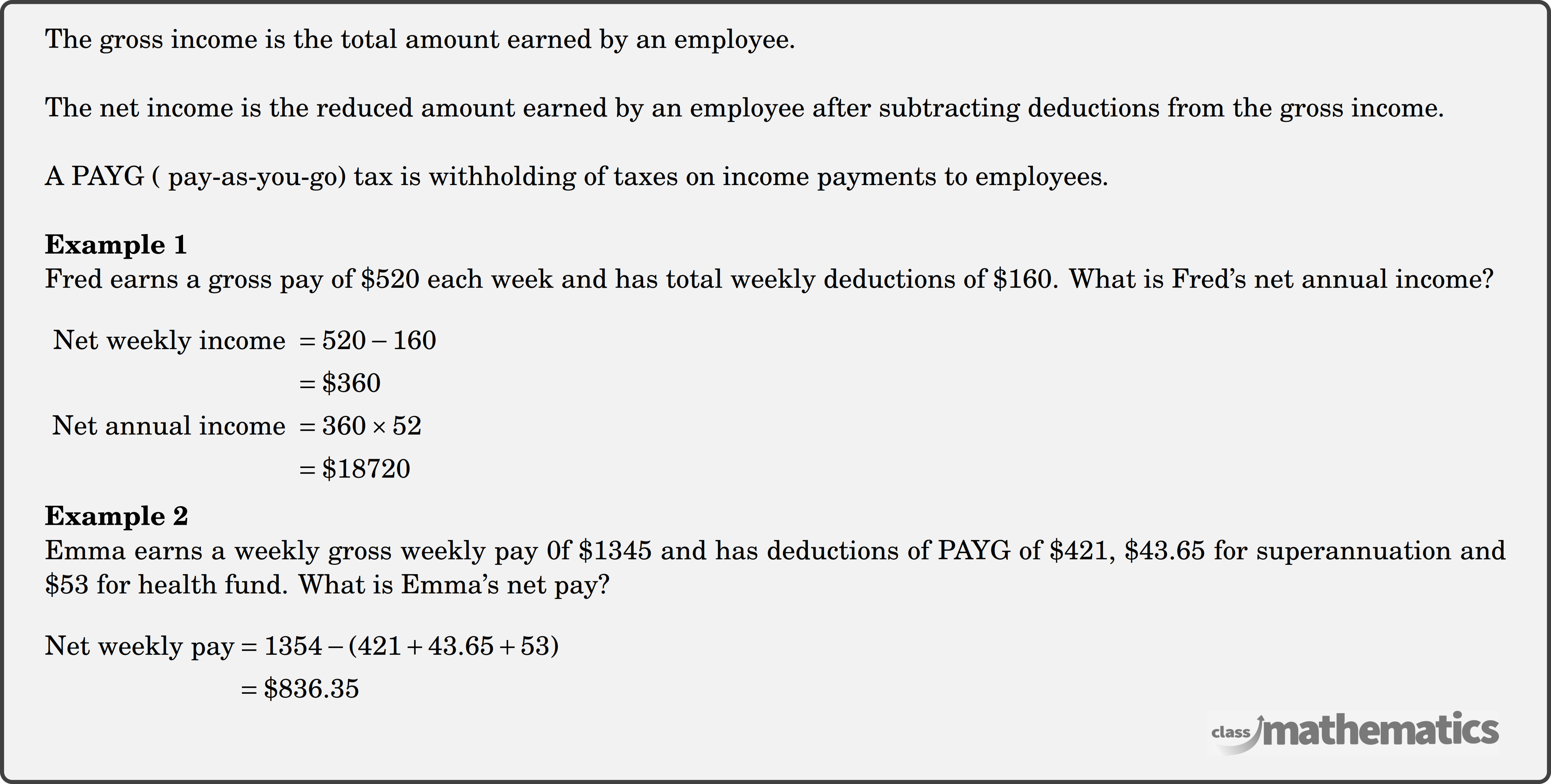

Gross Pay, Net Pay and Deductions Theory