Resources for Allowable Tax Deductions

-

Questions

13

With Worked SolutionClick Here -

Video Tutorials

1

Click Here

Allowable Tax Deductions Theory

13

With Worked Solution1

Videos relating to Allowable Tax Deductions.

With all subscriptions, you will receive the below benefits and unlock all answers and fully worked solutions.

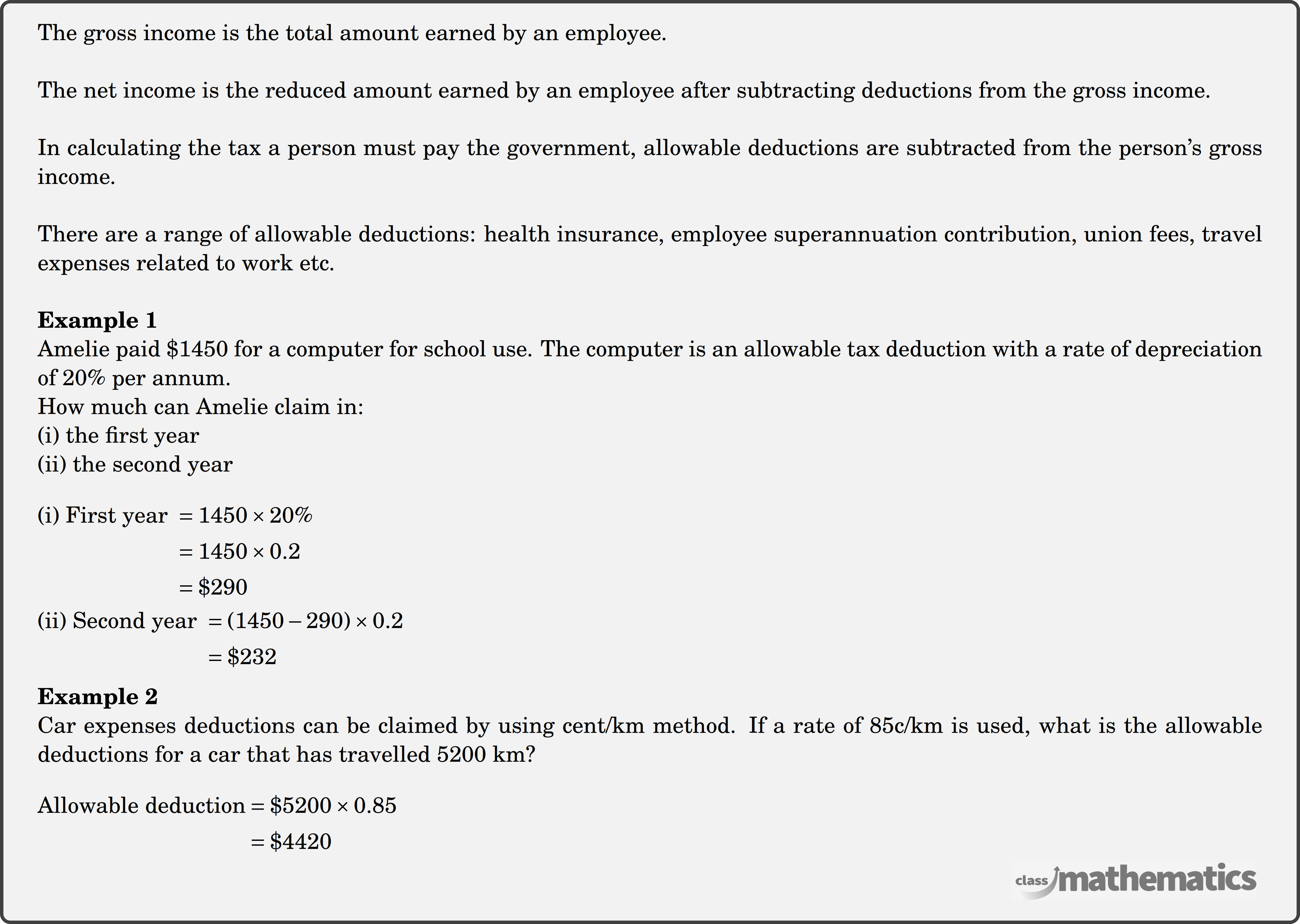

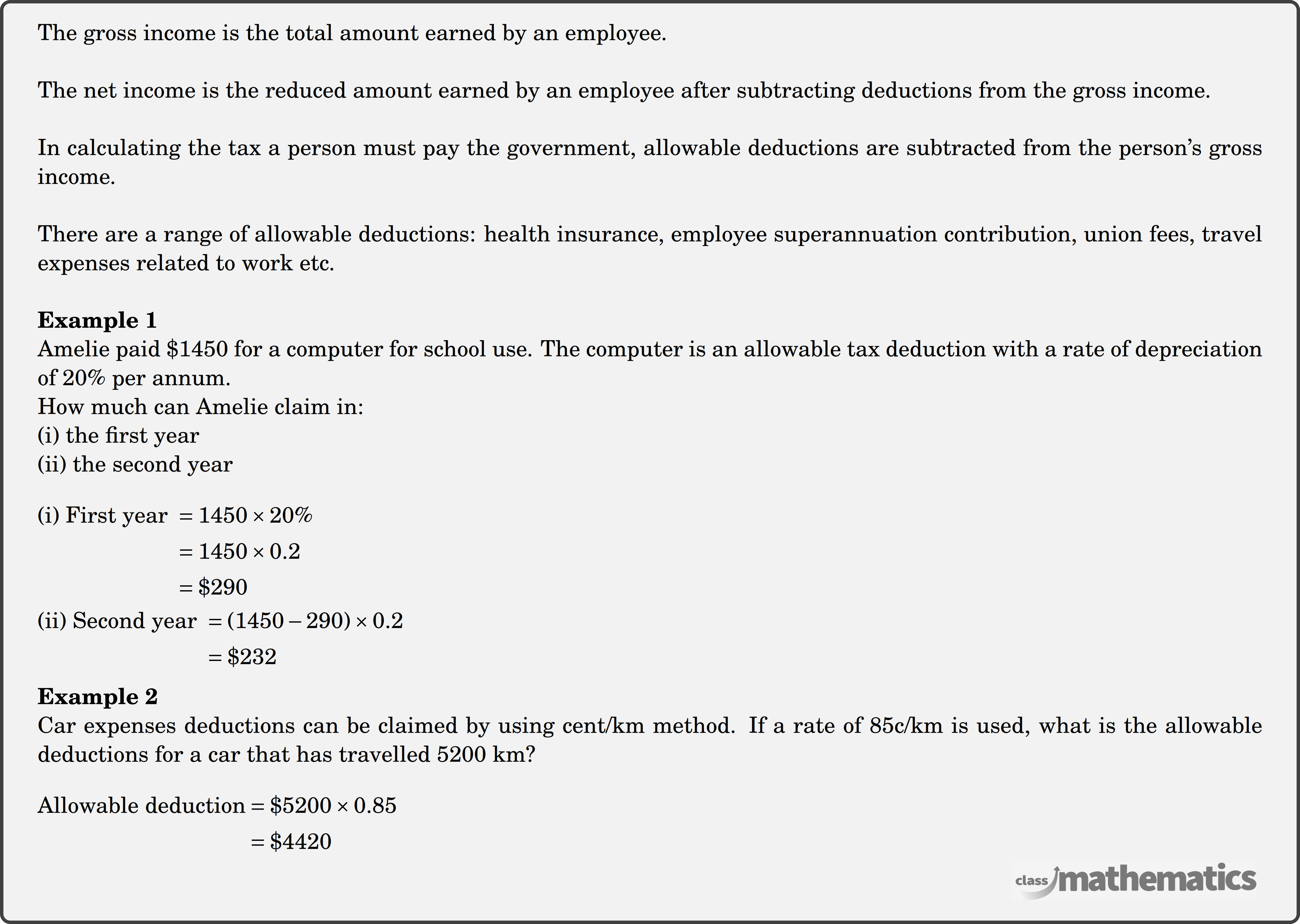

A person pays tax according to how much they earn. Tax deductions are a way of decreasing the amount of tax the government can take from you. Consider the two examples below: